Be Prepared – Ensure your Records are in Order

Be Prepared – Ensure your Records are in Order

By Myra Parker, CPA and Ben Hunter, III, CPA, CITP, CISA, CRISC, CFE

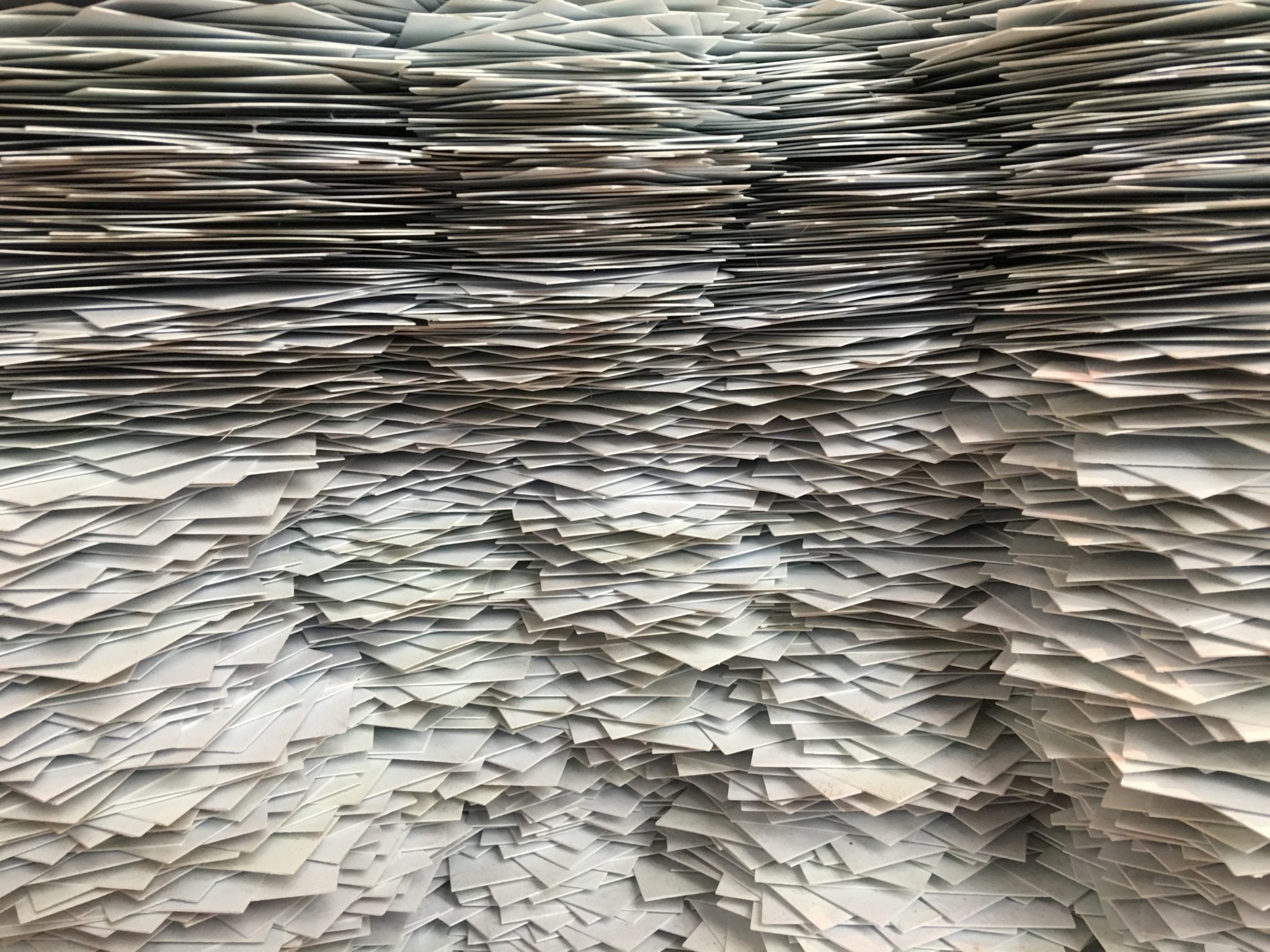

Whether you are a business or an individual, we all have some kind of bookkeeping to manage. Our present digital environment has made the amount of paper we handle less cumbersome, but the amount of data to manage can still seem overwhelming. Another hurricane season has almost come to an end, but not without much heartache, especially amongst our neighbors in North and South Carolina. How can we prepare our filing cabinets, both physical and electronic, ahead of a devastating event?

Here are a few tips to consider:

- Draft a list of all your assets and debts and review the listing at least annually to ensure it is current. Include a section with regard to your payment obligations which lists account numbers for utilities, credit cards, mortgage and other vendors in order for these obligations to be met in an event of your absence. Inform at least one trusted confidant or loved one that this list exists and where it can be found.

- Create a separate list of your passwords associated with the assets and debts. Use an electronic password manager or a document that is well hidden and stored somewhere safe. The National Institute of Standards and Technology (NIST) recommends that passwords be 20+ characters; therefore, the need to frequently change passwords has decreased. NIST recommends changing a longer password when you suspect it has been compromised. This makes it less cumbersome to store a list of passwords and update it annually with your assets and debts listing.

- Ensure that wills, healthcare and general powers of attorney, business organizational documents, tax forms, deeds, documents that establish basis for residences and other important assets, titles and insurance policies could be available to the right people.

- Consider storing copies of these key documents (as well as vital records such as driver’s licenses, birth certificates, social security cards, passports, etc.) in a waterproof container to be easily accessible in the event of an evacuation order. Also, consider keeping a copy of key documents with a trusted person outside of your geographic area and/or in a safe deposit box.

- Make sure you have copies of at least 3 years of tax returns available. If not, contact your tax preparer or the IRS for copies. Having access to tax returns will be important in the case of applying for loans or other disaster assistance.

- In reference to all the above documentation, consider taking advantage of paperless recordkeeping in an electronic format. Perform regular backups of the digital data and store a backup copy in a safe location other than your home or business. If you have a long password, cloud based storage of the data backup such as Google Drive, Amazon Drive, Box, Dropbox and others is an excellent choice.

- Consider electronic delivery and storage of bills and other recurring statements.

- Develop a Business Continuity/IT Disaster Recovery Plan as well as a team within your business that understands the emergency preparedness procedures, is ready to implement them when a disaster occurs and meets regularly. Having this plan and team in place will determine how quick operations may begin after an unfortunate event and how smooth difficult decisions are made. Also, communicate with your staff about the plan and team.

- Take pictures or make a short video to document your assets including the current status of buildings, inventory, equipment and its placement in your business. Store this information online or in another geographic area.

- Practice the habit of continually organizing and cleaning up your records. BRC has record retention polices for both businesses and individuals which can be found at: https://www.brc.cpa/resources/helpful-links/

Being ready not only gives you peace of mind, but also lessens the financial burden of the challenges we may be faced with. Are you and your business prepared?

![Myra Parker-7939-Edit[90] (2) Myra Parker-7939-Edit[90] (2)](https://www.brc.cpa/wp-content/uploads/2018/01/Myra-Parker-7939-Edit90-2-scaled-e1703020333918-270x270.jpg)

Myra J. Parker Tax Principal, CPA

Myra is a Tax Principal in our Dunn Office. She has 15 years of experience as a CPA. Myra started her professional career at Ernst & Young in Raleigh in 2006 and was with Oscar N. Harris & Associates, P.A. when the firm joined with BRC in 2017. At BRC, she focuses on individual […]