2018 Omnibus Spending Bill – Funding for Affordable Housing Programs

2018 Omnibus Spending Bill – Funding for Affordable Housing Programs

By Kristen Hand, CPA

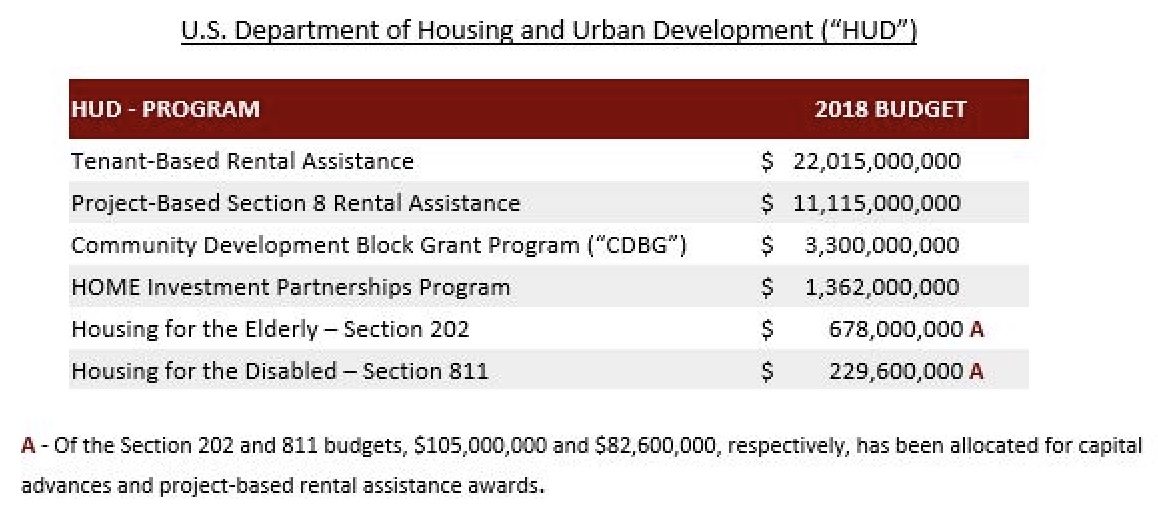

On Friday, March 23, the 2018 omnibus spending bill was signed into law. The 2,300-page document provides continued funding for affordable housing programs. Highlights of the awards granted and program changes are outlined below:

The bill increased the maximum number of public housing units that may participate in the Rental Assistance Demonstration (“RAD”) program from 225,000 to 455,000 and extended the program through September 30, 2024.

The House Committee on Appropriations expects the funding to provide funds needed to address housing needs and continue providing assistance to current tenants while adding new units to address the critical shortage of affordable housing.

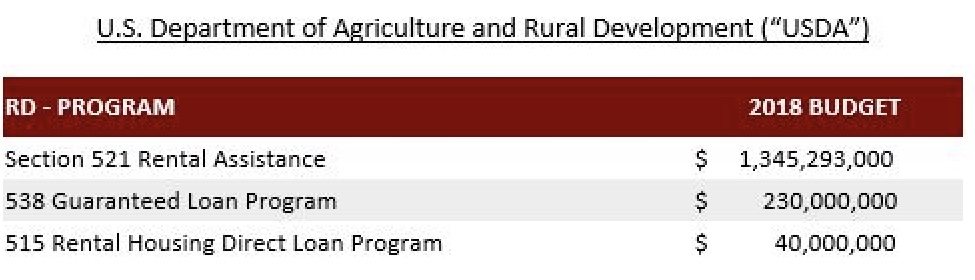

The 515 Direct Loan Program received a $7 million increase, while the 538 Guaranteed Loan Program remained unchanged from the prior year. Rental Assistance under Section 521 was awarded 4 percent less than the prior year.

Additionally, in an effort to incentivize nonprofit organizations and public housing authorities to acquire and maintain multifamily properties within the RHS program, the bill directs the USDA secretary to allow these entities a return on investment and an asset management fee of $7,500 per property.

Low-Income Housing Tax Credit (“LIHTC”)

The omnibus spending bill also includes modifications to the LIHTC program:

The State Housing Credit Ceiling was increased 12.5 percent for years 2018-2021. The Joint Committee on Taxation estimates that this increase will cost the federal government $6 million in 2018 and $2.718 billion over 10 years.

Additionally, the bill permanently establishes a new income limit option for LIHTC developments, in addition to the existing 40/60 or 20/50 options. Developers may elect to house tenants earning as much as 80 percent of area median income (“AMI”) so long as the average income limit of the property does not exceed 60 percent of AMI. At least 40 percent of the units must be rent-restricted and house tenants whose income does not exceed the imputed income limitation. This provision aims to offset lower rents for extremely-low and very-low income households with higher rents collected from households with incomes between 61 and 80 percent of AMI without other forms of subsidies. The Joint Committee on Taxation estimates that this provision will cost the federal government $109 million over 10 years.

The 2018 omnibus spending bill is voluminous and this summary does not include all the changes or awards to each program administered by HUD, USDA RD or the LIHTC program. The continued funding in the omnibus bill is a significant achievement for the affordable housing community, as these federal agencies can continue funding efforts to provide affordable housing throughout the United States to both current tenants and those in need of housing.