Significant Cuts to the Corporate Tax Rate – Is it More Beneficial to be a C-Corporation Now?

Significant Cuts to the Corporate Tax Rate – Is it More Beneficial to be a C-Corporation Now?

By Jill Clark, CPA

The Tax Cuts and Jobs Act that was signed into law on December 22, 2017 reduced the corporate tax rate from 35%, at the highest bracket, to a flat 21%. With such a significant rate reduction, many taxpayers are now asking the question of whether or not they would benefit from being structured as a C-Corporation for income tax purposes versus a flow-through entity. Unfortunately, the answer to that question is….it depends.

In order to answer this question, we need to make sure we have a basic understanding of the difference between how the income of a C-Corporation is taxed versus how the income of the same business structured as a flow through entity would be taxed. The income of a business structured as a flow through entity is taxed once. The income is included by the owners of the business on their individual income tax returns and they pay the tax on that income, at rates as high as 37%. The same business structured as a C-Corporation would pay tax on the income at the 21% flat corporate tax rate. However, when the earnings of the C-Corporation are subsequently distributed to the shareholders of the corporation, the shareholder must include those distributions in their taxable income. These “dividends” are generally taxed at a preferential rate of 15% or 20%. This is where the concept of “double taxation” for C-Corporations is derived.

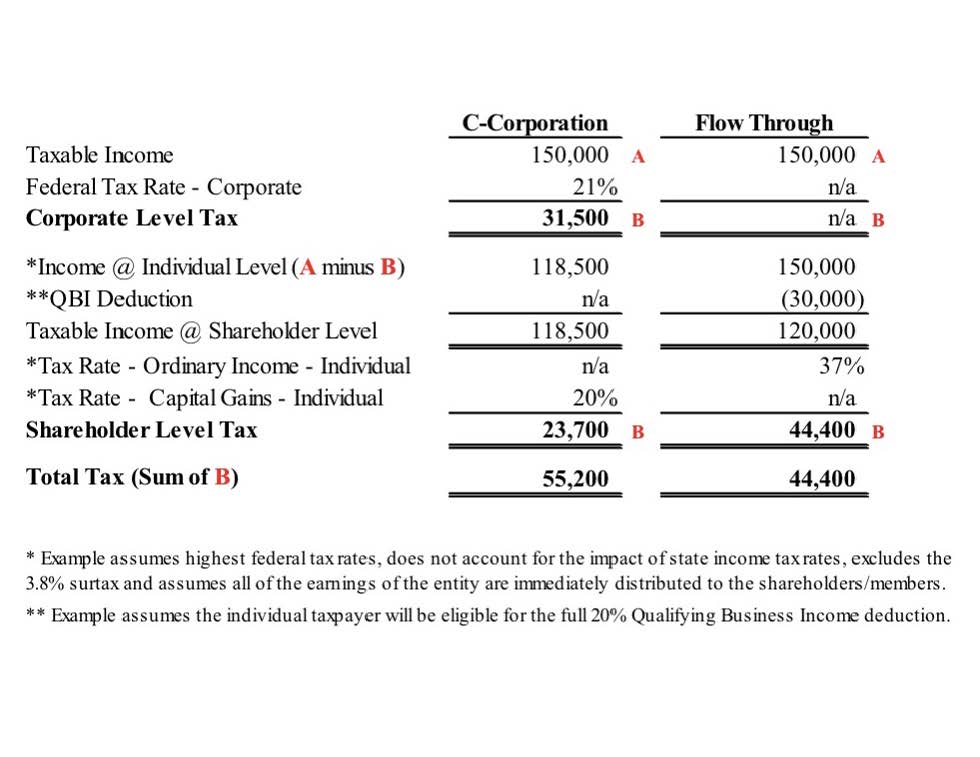

So, with that basic knowledge, let’s take a look at an example:

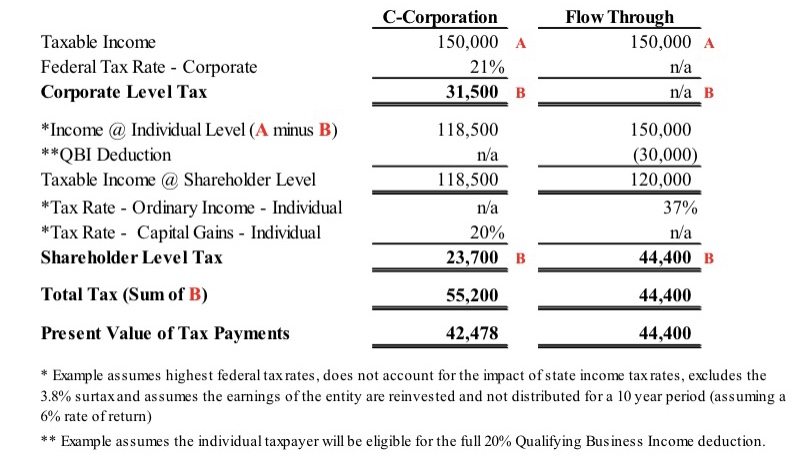

As illustrated in this fairly simplified example, being structured as a flow through entity provides a tax savings of $10,800. However, keep in mind, there are a number of different factors and assumptions that would impact this calculation, such as taking into account the difference in the state income tax rates of a corporation versus the rates for an individual, determining whether or not the income is eligible for the 20% qualifying business income deduction, and adjusting for the actual tax brackets of an individual including the applicability of the 3.8% surtax. In addition, the factor that seems to have the most significant impact when looking at this question is whether or not the corporation plans to or is required to distribute its earnings. If a C-Corporation delays the distribution of its earnings to its shareholders, the tax owed by the shareholder will not be paid until some point in the future. By delaying this tax payment, the concept of determining the present value of a future payment must be taken into consideration. So, let’s look at the exact same example, assuming that the corporation will reinvest its earnings for a 10-year period before distributing them to its shareholders and estimating the rate of return over that same 10-year period to be 6%:

The $23,700 tax payment owed by the shareholder of the C-Corporation will not be paid until the earnings are distributed, or in our example, 10 years later, so the present value of that amount must be determined. In this example, a 6% estimated rate of return was used, which results in the present value of the tax payments due (when structured as a C-Corporation) as $42,478. Therefore, in this example, it is more beneficial to be a C-Corporation from an income tax perspective. The take away from this example is that usually, the longer the earnings are reinvested (and not distributed) and the higher the estimated rate of return, the more likely being structured as a C-Corporation will prove to be beneficial for income tax purposes.

Keep in mind that there are a couple of mechanisms within the tax code that keep a corporation from delaying the distribution of its earnings by forcing the corporation to pay dividends. The Personal Holding Company tax and the Accumulated Earnings and Profits tax are both “rules” that are in place to force a corporation to distribute its earnings or pay a 20% penalty tax. This article is not going to go into the details surrounding these two provisions. Just be aware that the ability to hold the earnings at the C-Corporation level are not always available.

As you can see, there is no definitive answer to our original question. Like so many things within the tax code, it depends. However, unless there is a long-term plan to reinvest the earnings of a corporation combined with a relatively high estimated rate of return, it is likely going to be more beneficial from an income tax perspective to remain structured as a flow through entity – even with the significant cut in the corporate tax rate. However, every situation is different, and a more detailed analysis may be prudent to ensure the best decision is made for your business.

Jill W. Clark Director of Tax Quality Assurance, CPA

NC License #30742